Offering credit terms is always a risk, but that doesn’t mean you can’t turn the odds in your favor. By evaluating the financial health of business customers, you can mitigate your risk and make better credit decisions. The same holds true when you require the use of a guarantor. Often, when you’re dealing with a startup, a small business, or someone with a limited (or concerning) financial history, a guarantor can help you be more confident in your decisions.

The guarantor agrees to be responsible for repaying the debt if the primary borrower defaults. This additional layer of security gives you more options in your ability to get paid or recover in case of default, even if the business itself lacks the necessary creditworthiness. However, the success of this arrangement heavily relies on effective guarantor credit check services to help evaluate credit.

What Is a Guarantor on a Business Loan?

For lenders, the guarantor acts as a safety net, offering an additional layer of financial security when extending credit to a business that might not be able to meet traditional lending criteria. Guarantors are often required when the borrower’s creditworthiness or financial history is insufficient.

In business lending, guarantor services involve comprehensive background checks, credit evaluations, and legal processes that ensure the guarantor has the ability to repay the loan if necessary. Lenders will assess the financial health of the guarantor to gauge their risk, especially in cases where the business has a poor credit history or limited data, which can lead to higher exposure in the event of a default.

Guarantor credit check services help identify these risks and ensure that businesses only accept reliable, financially sound guarantors. Without these checks, you run the risk of extending credit based on faulty assumptions.

Guarantor vs Cosigner: Understanding the Differences

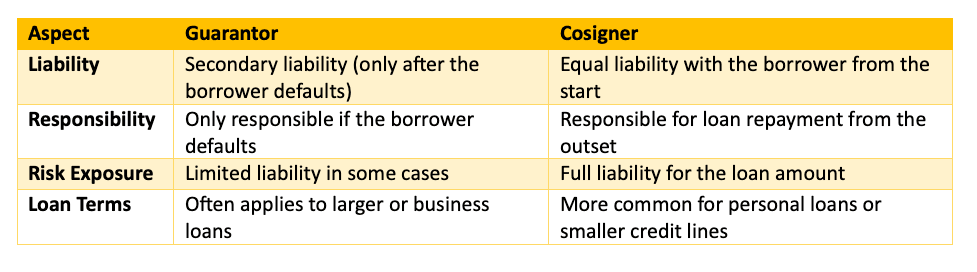

Isn’t a guarantor just a cosigner? Not really. While they can play similar roles, there are important distinctions you should know about.

Guarantor

A guarantor agrees to pay back the loan if the primary borrower defaults, but only after you try to collect from the borrower. The guarantor is a secondary source of repayment. Typically, the guarantor’s liability is limited to the amount of the loan they are guaranteeing.

Cosigner

A cosigner, on the other hand, shares equal responsibility for the loan from the outset. If the borrower defaults, the cosigner is immediately liable for the full amount of the loan.

Key Differences

Understanding the distinctions between a guarantor vs. cosigner can help you make better decisions about extending credit and determine which option aligns best with your risk tolerance

Why Credit Screening for Guarantors Is Essential

Over the past four years, the average risk of default for companies has more than doubled, to 9.2%, which makes credit screening for guarantors more important than ever. While in the past, you may have been content to run a business credit check on a company and record the name of a guarantor, in today’s economic climate, you need to check the credit history of the guarantor as well.

Credit screening for guarantors is an essential step in minimizing exposure and ensuring that a loan’s repayment is as secure as possible.

When performing a guarantor credit check, you should evaluate the guarantor’s:

- Credit score

- Credit utilization

- Repayment history

- Existing liabilities

- Liens, judgments, or bankruptcies

Guarantor Credit Check Services: What to Look For

Effective guarantor credit check services should provide you with the data you need on the financial history of the individual or entity acting as the guarantor. A solid credit check service will include the following elements:

- Credit report analysis: Examines the guarantor’s credit score, payment history, outstanding debts, and credit utilization.

- Public records review: Identifies any bankruptcies, tax liens, judgments, or other legal issues that could affect the guarantor’s financial stability.

- Asset verification: Ensures that the guarantor has the necessary assets (real estate, investments, etc.) to back the personal guarantee.

- Income and employment verification: Assesses the guarantor’s income level and employment status to determine their ability to fulfill the guarantee if necessary.

With a comprehensive look at the business and guarantor’s financial health, you can reduce the likelihood of a default on a business loan with a personal guarantee.

Rules for Loan Guarantor: Compliance Essentials

When requiring a guarantor in a business loan agreement, there are specific compliance rules and regulations to protect all parties involved.

Rules for loan guarantors are meant to protect both the lender and the guarantor and make sure everyone understands their responsibilities, rights, and obligations. Compliance with these guidelines is a legal requirement and a best practice to maintain transparency and avoid legal complications.

While you should always check with your legal advisor before putting practices into place, some of the key regulations governing loan guarantees include:

Disclosure Requirements

One of the fundamental compliance requirements when involving a guarantor in a business loan is the disclosure of the terms and conditions associated with the guarantee. The lender must clearly communicate to the guarantor the exact financial obligations they are assuming.

This includes detailing the total amount of the loan, the repayment schedule, the conditions under which the guarantee becomes enforceable, and any other terms that may affect the guarantor’s responsibilities.

The lender must also make sure the guarantor understands that they may be required to pay off the entire debt if the primary borrower defaults on a business loan with a personal guarantee. Full transparency at this stage is essential to avoid misunderstandings that could lead to disputes or legal challenges.

Consent and Agreement

Before a person or entity can act as a guarantor, they must provide formal written consent confirming their understanding and acceptance of the terms of the guarantee. This step is essential to establish the legal enforceability of the agreement.

The guarantor must acknowledge their understanding of the risks involved, particularly the possibility that they could be responsible for the debt if the borrower defaults. This signed agreement should clearly outline the nature of the guarantee, any limits on the guarantor's liability, and the consequences of a default. Proper documentation of this consent is necessary to ensure that the guarantor is legally bound by the agreement.

Fair Credit Practices

Lenders are required to follow fair credit practices when assessing the financial background of the guarantor. The process of obtaining and evaluating a guarantor's credit report must be done in full compliance with the Fair Credit Reporting Act (FCRA).

This regulation ensures that the lender uses accurate and non-discriminatory information to make their decision regarding the guarantor's financial capability. The lender must inform the guarantor about the nature and purpose of the credit check, as well as their right to dispute any inaccuracies in the report.

So, make sure to get written consent to run consumer credit reports on a guarantor. While you are not required to get written consent for a business credit report, many businesses ask for permission as part of the standard credit application to avoid conflicts.

Recordkeeping

Proper recordkeeping is another critical compliance requirement for businesses that involve a guarantor in a loan agreement. Lenders must maintain accurate, detailed records of the guarantee agreement, the credit checks conducted on the guarantor, and any communications between the lender and the guarantor.

This documentation is important for regulatory purposes, especially if the loan defaults or legal disputes arise. It demonstrates that you adhered to all legal requirements and followed the correct procedures in securing the guarantee.

Proper recordkeeping may also protect you from lawsuits or regulatory penalties related to improper handling of guarantor information.

After Default on a Business Loan with a Personal Guarantee: What Happens Next?

Despite the best efforts to screen and assess the risk, there are times when a default on a business loan with a personal guarantee occurs. When this happens, you need to act quickly to recover the owed amount. The process usually involves:

- Initial attempts to collect from the borrower: First, attempt to collect the debt from the primary borrower. You may want to offer payment plans or other ways to satisfy the debt to avoid losses and keep customers.

- Engaging the guarantor: If the borrower fails to repay, you will then need to pursue the guarantor for repayment. This may involve negotiating a payment schedule or seeking legal action.

- Legal process: If the guarantor is unable (or unwilling) to pay, you may need to pursue legal action, work with a collection agency, or sell the debt.

Having a clear understanding of the legal options and rights associated with a default on a business loan with a personal guarantee is essential and should influence your future lending policies and recovery strategies.

Best Practices for Managing Guarantor Relationships

In any business relationship, transparency and trust are important. Maintaining strong relationships with guarantors is crucial for minimizing risk and ensuring smooth loan repayment.

You should

- Clearly define expectations: Ensure that both the borrower and the guarantor understand their roles, responsibilities, and potential liabilities.

- Regularly monitor guarantor status: Continuously assess the financial health of the business and guarantor, especially in long-term credit agreements.

- Establish transparent communication: Keep an open line of communication with the guarantor, providing regular updates on the loan’s status and any issues that arise.

- Document everything: Ensure all agreements and communications are properly documented, to avoid legal complications downstream.

By managing guarantor relationships carefully, you can make sure both parties are aligned and prepared in the event of a default. The sooner you identify problems, the more likely you are to resolve them. If you wait until a default occurs, it may be too late. For example, if a company heads to bankruptcy, you may be at the back of the line, especially for unsecured loans.

Many businesses leverage account monitoring services to alert them in case there’s a negative change to a customer or client’s financial position or that of a guarantor. You may also want to consider portfolio scoring and analysis to evaluate your entire credit portfolio to make sure it stays aligned with your risk tolerance.

Building Safer Lending Strategies Through Guarantor Oversight

Incorporating business credit checks, consumer credit reports, and guarantor credit check services into your lending helps you to manage risk and ensure compliance, reducing the likelihood of default.

Improve your credit risk management strategies by partnering with Command Credit. Get business and consumer credit reports instantly with no long-term subscriptions. We also offer portfolio scoring and analysis, ongoing account monitoring, background investigations, and more, to protect your bottom line.

FAQs—Frequently Asked Questions About Credit Screening for Guarantors

What is the main purpose of a guarantor in business lending?

A guarantor provides an extra layer of financial security by agreeing to repay a loan if the business borrower defaults. This reduces risk for the lender, especially when the business lacks a strong credit history.

How is a guarantor different from a cosigner?

A guarantor is only responsible if the borrower defaults and collection efforts fail, while a cosigner shares equal responsibility for the loan from the start. Cosigners are more common in personal lending; guarantors are typical in business loans.

Do I need to do credit screening on guarantors if I have already checked the business?

Yes. Even if the business passed a credit check, the guarantor’s creditworthiness should be independently evaluated to ensure they can fulfill the obligation if needed.

What information should a guarantor credit check include?

A comprehensive credit check should include credit scores, repayment history, outstanding debts, liens or judgments, income verification, and asset ownership to fully assess financial stability.

Is written consent required to run a guarantor’s credit report?

Yes, written consent is required to run a consumer credit report, under the Fair Credit Reporting Act (FCRA). While not required for business credit reports, obtaining consent is still considered best practice.

Can I monitor a guarantor’s financial health after I grant credit?

Yes, many lenders use account monitoring services to track changes in a guarantor’s credit status, helping them take proactive steps if financial issues arise.

Learn more about credit screening for guarantors by connecting with the experts at Command Credit today.