In business, making sure you have enough cash coming in to pay your employees, overhead, and suppliers is essential. So, if any of your clients or customers are experiencing financial stress and cannot pay their bills on time, it can hurt your cash flow and working capital. A significant default from someone to whom you have extended credit can create a ripple effect in your business—making it tougher to pay your employees and suppliers.

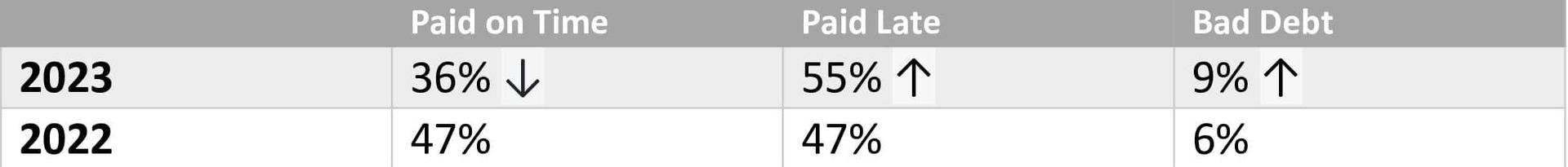

The latest Payment Practice Barometer shows some warning signs. U.S. companies experienced increased risk from late payments and bad debts from B2B trade credit over the past year. A survey of businesses showed that more than half of all invoices are past due and bad debts are averaging 9% of credit-based sales. Fewer bills are being paid on time.

Against this backdrop, businesses need to step up their credit monitoring and collection processes to protect themselves.

How Credit Account Monitoring Works

Account monitoring can automate the process of keeping an eye on a client's financial health. Tracking customer business credit reports and scanning for changes in credit scores, repayment histories, or adverse public filings can provide an early warning of financial distress. With this information, you can take proactive measures before it is too late.

Setting Up Account Monitoring and Control

Implementing credit account monitoring is a strategic move to mitigate your risk when extending credit. Services like Command Credit can make account monitoring easy.

With Command Credit, you get comprehensive tracking and real-time alerts when conditions change. When a client or customer starts going delinquent on bills from other companies, gets hit with a judgment or lien, files for bankruptcy, or sees a notable drop in their credit score, you get an alert.

Even when there is a significant change in the financial health of your customers, it is easy for it to fall through the cracks. They might be paying you on time but showing signs of financial distress elsewhere. They might have been good, solid customers for years, but you may not know they are struggling now.

While you keep an eye on some of this manually by pulling business credit reports for your key clients monthly or quarterly, you might miss something when comparing previous reports. Small business owners have to wear a lot of hats, and you may not have a team of financial analysts to monitor credit manually. You are better off with an automated credit account monitoring system that does the work for you

Credit Portfolio Analysis

While you want to monitor key accounts, you can also benefit from portfolio analysis. This helps you understand your overall risk based on account health and diversity. By scoring your present accounts receivables, you can establish a baseline to help determine your risk tolerance. When your portfolio no longer aligns with your tolerance level, you can take steps to bring it back into alignment.

You can also identify clients who may be struggling and decide whether you need to make changes to your credit extension or collection policies.

Being Proactive

When you spot changes to a client or customer’s financial health, it creates an opportunity for intervention before their problems become yours. Armed with the facts, you can have conversations to discuss collections and offer solutions that protect your business interests. Examples might include:

- Renegotiating payment terms, such as implementing biweekly invoicing

- Requesting cash upfront or deposits for future orders

- Reducing credit limits to lower exposure

- Creating payment plans with penalty clauses for failing to meet conditions

- Offering early payment discounts to incentivize prompt payment

- Requiring personal guarantees from small business owners

- Implementing automatic payment or debit arrangements

- Adding late payment penalties for past-due invoices

These examples could apply to individual accounts or trigger changes in your overall policies based on your credit portfolio analysis. Either way, being proactive puts you ahead of the game, not waiting until there is a default and joining a long line of other creditors waiting to be paid.

Being proactive can also help you maintain a positive relationship with your customer. While other businesses may take a heavy hand with collections, you can offer proactive solutions that can help your clients or customers weather the rough patches. This can produce loyal customers who remember that you were there to help when things turned down.

If you would like to learn about how credit monitoring and portfolio scoring can help your business lower your credit risk exposure, talk to the experts at Command Credit today.