Credit risk management is key to making solid business decisions and ensuring your credit portfolio accurately evaluates exposure. As a credit manager, you have an important role in protecting your company, finding opportunities, and balancing liabilities to protect your organization from risks.

Traditionally, this process has relied heavily on quantitative factors like financial ratios, credit scores, and payment histories. While these metrics provide a solid foundation, they do not tell the whole story. Qualitative credit risk factors, on the other hand, include factors like leadership quality, market trends, and business relationships. These factors offer a more nuanced perspective and help credit managers make informed decisions.

What Is Qualitative and Quantitative Risk Assessment?

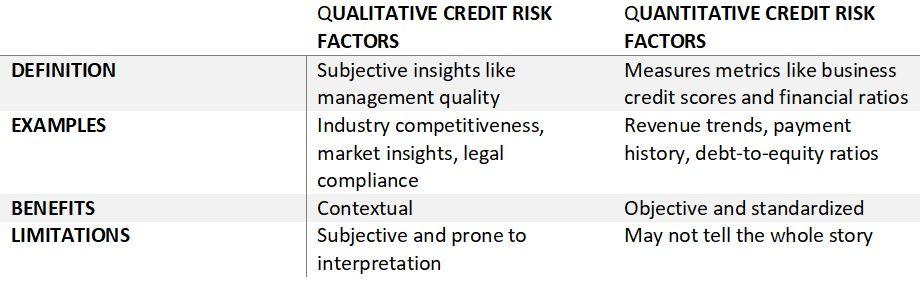

Credit risk assessment typically combines two approaches: quantitative and qualitative. Each method has its strengths, so evaluating both types of risk assessments provides a more holistic approach.

Let’s compare qualitative credit risk factors with quantitative credit risk factors.

Key Qualitative Credit Risk Factors

Let’s break down the key components of quantitative credit risk and the factors credit managers evaluate:

Management Quality and Experience

The leadership team plays a critical role in a company’s success. Assess their background, industry expertise, and track record. A capable management team is more likely to navigate challenges effectively.

Industry and Market Conditions Analyzing market trends, competitive pressures, and the economic outlook for the industry provides context, allowing you to compare performance against industry leaders to see if companies are trending up or down compared to their competitors.

Business Model and Strategy

Evaluating the sustainability of the business model and an organization's ability to adapt to changing market conditions can help you assess resilience in case of uncertainty. With changing governmental policies and monetary policies, you want to know about a company’s ability to pivot.

Regulatory and Legal Environment A company’s compliance history and exposure to liability can significantly impact its risk profile. Frequent legal disputes or regulatory violations are red flags. While some risks will show up in quantitative risk analysis, looking at industry sectors can help you gauge specific risks.

Reputation and Relationships Assess the company’s reputation among customers, suppliers, and other stakeholders. Strong, positive relationships often indicate stability and reliability. Likewise, negative sentiment can foretell potential problems that will not have shown up yet in company financials or business credit scores.

Why Qualitative Factors Matter

Quantitative data is incredibly valuable when you are examining business credit risk. It can provide you with details about credit utilization and payment history and flag potential warning signs of deteriorating financial health. However, it can also lack context to assess the full spectrum of credit.

For instance, a company with strong financials but a high turnover rate among executives may still pose a risk due to potential instability in leadership. A major shift in buyer behavior in a particular industry segment can present bigger risks that aren’t apparent when reviewing a credit score based on past history. Take, for example, a manufacturing firm with a solid revenue base but operating in a highly competitive and declining industry. Quantitative data might show positive financial ratios, but qualitative analysis could reveal vulnerability to market saturation, presenting greater exposure in your supply chain.

Assessing Qualitative Credit Risk Factors

Evaluating these credit risk factors means playing detective. While you can learn a lot by doing online research, it often takes strategic and targeted approaches. Credit risk managers are increasingly leveraging third-party providers like Command Credit to go beyond basic business credit reports and ongoing credit monitoring to conduct investigations for high-value customers and suppliers.

Credit managers also advise their teams to interview key executives and industry experts to understand management structure and motivations. Staying on top of industry-specific and category-specific trends helps provide greater context to quantitative data.

Improving Business Credit Risk Management

Combining finite data with qualitative research is key to modern business credit risk management. Leveraging technology and resources from providers like Command Credit can provide you with a holistic evaluation and help you make more informed decisions to reduce risk and benefit from opportunities.

See how Command Credit can help with business credit reports, credit portfolio analysis, ongoing credit monitoring, and more. Contact Command Credit today.