Commercial credit underwriting is often treated as a simplified extension of consumer credit underwriting. Pull a business credit report, check the score, and move the decision forward. That approach may feel efficient, but taking that approach is one of the most common reasons organizations make mistakes in evaluating risks that may lead to losses.

Doing a credit check for business requires different data, assumptions, and processes than consumer credit underwriting.

What Business Credit Underwriting Really Means

Business credit underwriting is the structured evaluation of a company’s ability and willingness to meet its financial obligations. Unlike consumer underwriting, which centers on an individual’s repayment behavior, commercial credit underwriting must account for entity structure, operating history, industry dynamics, and, sometimes, reporting fragmentation.

Since each credit bureau evaluates credit differently and uses different sources, there can be information gaps when working with a particular business credit service. Effective underwriting often combines multiple data sources, trend analysis, and verification steps to form a more stringent risk assessment.

The Modern Business Credit Risk Landscape

The need for stronger underwriting has increased as access to traditional financing has tightened. Large banks are currently approving only 13% of small business loan applications, pushing more companies toward trade credit, alternative lenders, and extended payment terms.

The American Bankers Association’s Economic Advisory Committee, made up of chief economists from some of North America’s largest banks, is forecasting economic growth and lowering the risk of a recession to 32.5% by the end of 2026. Still, business default rates are still higher than normal, meaning credit checks for businesses remain an important tool in protecting your cash flow.

Business Credit vs Consumer Credit: Critical Differences Underwriters Must Understand

Businesses are not people, even when ownership overlaps. A company can remain viable despite an owner’s personal financial stress, and a strong personal credit profile does not guarantee a healthy business.

Commercial credit reports rely heavily on trade reporting, which is voluntary and uneven. Some creditors report to one bureau, others to several, and many do not report at all. This can produce uneven results that can impact your trade credit underwriting decisions. Moreover, the absence of data doesn’t always imply low risk.

How Do I Verify Customer Creditworthiness?

Verifying customer creditworthiness begins with defining what “creditworthy” means in a commercial context. At a minimum, you should use a business credit report to review:

- Credit scores

- Payment behavior

- Trade history

- Public records

Payment trends matter more than static balances. For example, a business that pay slowly, but pays consistently, may be less risky than one that pays early in most cases but has outstanding delinquencies. And that knowledge can help you adjust your underwriting policies. So, when a credit check for business shows someone typically pays beyond terms, you can offer early-payment incentives or higher interest rates to reflect your risk.

While a commercial credit report score is helpful, creditworthiness is best evaluated in terms of patterns. A business may have been a low risk for years, but changing conditions show up first in underlying patterns before impacting scores.

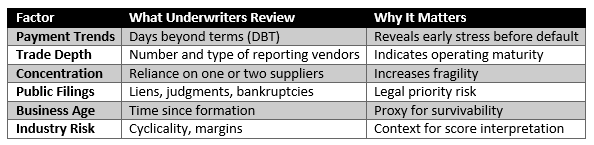

Here are some of the key trends that credit verification services keep an eye on:

How Do I Get a Business Credit Report or Consumer Credit Report?

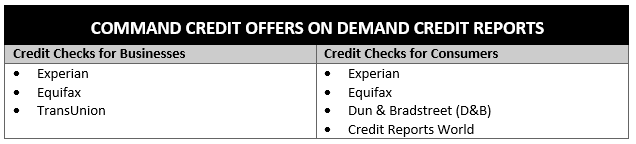

Command Credit allows you to do credit checks for businesses or consumers. You can pull reports on demand without signing up for a long-term subscription. You can also choose from different credit bureaus or multiple ones.

Trade Credit Underwriting: Evaluating Vendor and Supplier Risk

Trade credit underwriting differs from lending underwriting in both scale and purpose. Suppliers are often managing dozens or hundreds of smaller exposures rather than a few large loans.

Key indicators include days beyond terms, trend direction, and changes in payment behavior over time. A customer who is slowly stretching payments may signal emerging stress even if balances are small. With trade credit underwriting, it’s more about the direction a company is headed rather than the current balance.

Commercial Credit Underwriting for Higher-Risk Decisions

Higher-dollar exposure or strategic relationships may require more due diligence. In these cases, underwriters should expand beyond surface-level credit data to include operating history, concentration risk, and external pressures such as industry volatility.

The cost of deeper underwriting is often far lower than the cost of a single bad decision.

Consumer Credit Underwriting in Business Decisions

Consumer credit underwriting still plays a role in some business contexts, particularly for closely held companies, startups, or personal guarantees. However, it should supplement, not replace, commercial analysis.

Overreliance on owner credit can distort your risk assessment, especially as businesses grow and operations diverge from personal finances. However, in many cases, you may want to evaluate an owner’s personal credit history, especially if there is a personal guarantee or limited financial history.

Do I Need Permission to Check Business Credit?

Permission requirements are one of the most misunderstood aspects of commercial underwriting. While you need permission to pull reports for consumer credit underwriting, you do not need permission to pull business credit reports.

This distinction matters. Mixing consumer and business data without understanding consent requirements can create compliance risk. You must be clear about which data you use and why.

Credit Verification Services: Filling the Gaps

Credit verification services can help you verify entity identity, match records accurately, and confirm that data applies to the correct business. This reduces the risk of false positives and misattribution. Verification is especially important when dealing with common business names, recent incorporations, or complex ownership structures.

Common Business Credit Underwriting Mistakes

The most common underwriting mistakes typically occur in interpreting data. Relying simply on a business credit score can miss warning signs hidden in the data. Here are some of the most common mistakes businesses make:

- Overreliance on personal credit scores: Focusing too heavily on the owner's personal credit rather than evaluating the business's actual financial health and cash flow.

- Insufficient cash flow analysis: Missing seasonal patterns, timing gaps, or one-time events by not analyzing actual cash flow deeply enough.

- Ignoring industry context: Applying uniform standards across all sectors instead of recognizing that healthy metrics vary by industry.

- Inadequate collateral valuation: Overestimating asset values or accepting hard-to-liquidate collateral that won't hold value in a forced sale.

- Missing financial statement red flags: Failing to spot inconsistencies, related-party transactions, or verify statements with tax returns and qualified accountants.

- Underestimating debt service coverage: Setting coverage ratios too low, leaving borrowers overleveraged and vulnerable to minor disruptions.

- Neglecting management assessment: Not adequately evaluating the owner's experience, industry knowledge, and track record for success.

Another mistake is assuming that companies with thin credit files are bad risks. Many financially healthy businesses have thin or nonexistent credit files. This is common among newer businesses, companies that rely on cash or ACH payments, or firms with vendors that do not report trade data.

You must determine whether a business legitimately shows a thin reporting history or is actively avoiding visibility. Checking trade references, payment velocity, business verification, and consumer credit reports (where applicable) can help. Thin credit files should not be an automatic decline, but do require further scrutiny.

Building a Scalable Business Credit Underwriting Process

A scalable business credit underwriting process is designed to apply the right level of scrutiny to each decision without slowing you down. You don’t want to approach every customer the same way, but your scrutiny should increase in proportion to the financial exposure and risk you take.

Effective frameworks typically use tiered decision models. For example:

- Low-exposure approvals may rely on streamlined checks such as basic business credit reports, trade history review, and verification of entity details.

- Moderate-risk decisions introduce deeper analysis, including payment trend evaluation, cross-bureau comparison, and industry context.

- High-risk or high-dollar approvals require comprehensive underwriting that may include expanded commercial credit reports, guarantor review, concentration analysis, and manual judgment.

Scalability also depends on clear escalation rules that move accounts from one tier to another. When you see balances start to grow quickly, payment trends deteriorate, or new public filings show up, you need to take another look. Even companies with long-standing histories of on-time payments and financial backing can show signs of distress. You want to see those before they become your problems.

A scalable business credit underwriting process should include ongoing credit checks for businesses so you can avoid missing emerging trends. You may also want to conduct regular credit portfolio assessments to make sure your exposure stays within your risk tolerance.

Documenting Your Underwriting Standards

Documented underwriting standards are essential at every tier. They create consistency across teams and protect decision quality as volume grows. More importantly, documentation makes your underwriting process defensible. When decisions are questioned internally by counterparties or during audits, clearly articulated criteria are essential.

Standardized policies also help with consistency. New team members can be onboarded faster; decision quality becomes less dependent on individual experience, and institutional knowledge is preserved. These policies also provide greater transparency for clients and customers, helping them better understand credit decisions.

Monitoring and Ongoing Credit Risk Management

Business credit underwriting does not end once a customer is approved. Credit risk is dynamic, and companies that treat underwriting as a one-time decision often miss early warning signs that appear well before a default or payment failure.

Ongoing credit risk management focuses on identifying changes in behavior. Common early indicators include:

- A gradual increase in days beyond terms

- Declining payment velocity across multiple tradelines

- Sudden increases in credit balances

- The disappearance of previously reported trade accounts

While defaults, new liens, judgments, bankruptcies, and collections are obvious signals, there are often more subtle shifts that precede such actions. Spotting these trends lets you take action earlier to reduce exposure.

Effective monitoring operates at two levels:

- At the transaction level, individual accounts are reviewed for deviations from expected payment patterns.

- At the portfolio level, aggregate trends reveal whether your risk is isolated or systemic, such as industry-wide slowdowns or regional stress.

The goal of monitoring is not constant intervention, but timely adjustment. With information in hand, you can make adjustments to protect your business. This might include tightening credit limits or terms or requiring upfront deposits or payments.

Business credit services that support automated alerts and periodic reviews can help you scale this process without overburdening your internal team.

Commercial Credit Underwriting Requires a Disciplined Approach

Underwriting business credit correctly requires a disciplined approach. Clear policies and consistent application are key to giving you control over risk.

FAQs — Frequently Asked Questions About Business Credit Reports

What shows up on a business credit report?

Business credit reports typically include identity, tradeline data, payment history, public records, collections, and risk indicators, though coverage varies by bureau.

How do I run a credit check for my business?

You can pull a business credit report on your business through Command Credit. You can sign up, input your information and payment, and pull a report instantly.

How often should business credit be reviewed?

Credit should be reviewed anytime you’re extending credit or onboarding a new supplier. You should also pull periodic reports or sign up for continuous monitoring. Higher-risk accounts need more frequent monitoring.

Can I underwrite business credit without a credit score?

Payment trends, trade references, public records, and verification data can support underwriting even when scores are limited or unavailable. However, the three major credit reporting bureaus all provide overall credit scores and various risk scores.

What industries require stricter commercial credit underwriting? Industries with thin margins, long payment cycles, or economic volatility often require deeper and more frequent underwriting.

To evaluate and strengthen your commercial credit underwriting process, schedule a free consultation with Command Credit and align your credit decisions with real-world risk.