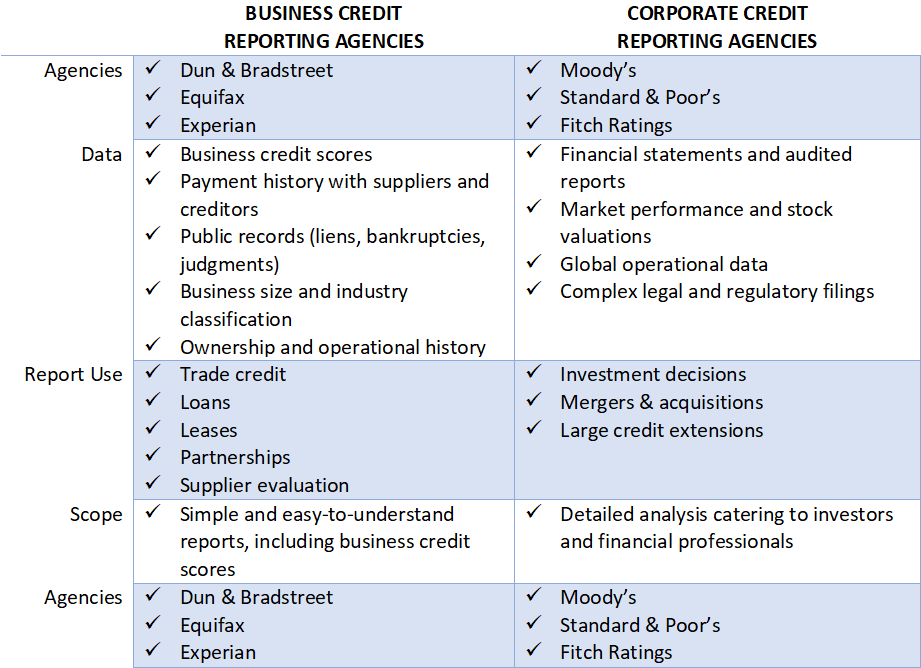

While the terms are used interchangeably, there are a few key differences you should be aware of between business credit reporting agencies and corporate credit reporting agencies. While much of the same information is collected by both, the data is used differently.

Business Credit Reporting Agencies

Agencies like Dun & Bradstreet, Equifax, and Experian focus on individual businesses and small- to medium-sized enterprises. Their credit reports are valuable for lenders who are making credit decisions and for businesses that need to evaluate the creditworthiness of their customers and suppliers.

Corporate Credit Reporting Agencies

Agencies like Moody’s, Standard & Poor’s, and Fitch Ratings focus on large corporations and multinational companies. The reports they provide are used by investors, large-scale lenders, and government regulators.

Key Differences

This chart summarizes the key difference between business credit reporting agencies and corporate credit reporting agencies.

How Are Business Credit Reports Used?

Business credit reports are most commonly used when a seller considers extending trade credit to a buyer. The seller wants to ensure they’ll get paid for the goods they’re providing within the terms they’re offering, like net 30 or 60. The seller might have to invest in raw materials or inventory to fulfill the order, so they want assurance that the buyer has the financial means to live up to their obligations.

A business credit report contains an overview of the buyer’s credit and payment history along with any negative marks. If the credit score is high and the business has a history of paying on time, the seller can be more confident in extending credit. If there are red flags in the report, the seller might reconsider committing to the transaction or decide to amend the payment terms to balance the risk.

How Are Corporate Credit Reports Used?

Corporate credit reports look at the creditworthiness of large corporations. A common application is evaluating the company’s financial health before making an investment. For example, an institutional investor might be considering buying corporate bonds for a company and want to make sure it’s a wise investment.

Corporate bonds are a type of loan to the corporation with the promise of receiving a return of principal at maturity and interest during the term. Before committing funds, the investors need to review corporate credit reports to assess the likelihood that the corporation will be able to meet its debt obligations.

If the company has a strong financial position with a low risk of default, the investor can feel more confident about directing funds to bonds with less risk. In the same way, a poor corporate credit report may cause the investor to reconsider or require a higher rate of return to offset the potential risk.

Such reports are also incredibly valuable for extremely large transactions or in mergers and acquisitions where due diligence is essential.

Limitations of Business and Corporate Credit Reports

There are some limitations to both business and corporate credit reports, so you should make sure you get the right information for your use.

Business credit reports provide significant insight into a company’s financial health and payment history-ideal for companies making credit decisions. However, they lack detailed financial insights that large investors may require. They generally do not include audited financial statements, projections, or analyses of market performance, which are critical for evaluating a company’s long-term viability or assessing large-scale investment opportunities.

Corporate credit reports have detailed information and financial metrics, such as revenue performance, audited financial statements, global operational scope, and regulatory filings. This kind of data is crucial for high-stakes financial decisions. However, their focus means they typically overlook smaller-scale details like trade credit behavior or supplier payment history, which is needed for businesses assessing risk in day-to-day transactions.

Get Business Credit Reports

You can get business credit reports from Dun & Bradstreet, Equifax, and Experian at Command Credit. Enter your information, and you can instantly pull business credit reports without having to sign up for long-term subscriptions.